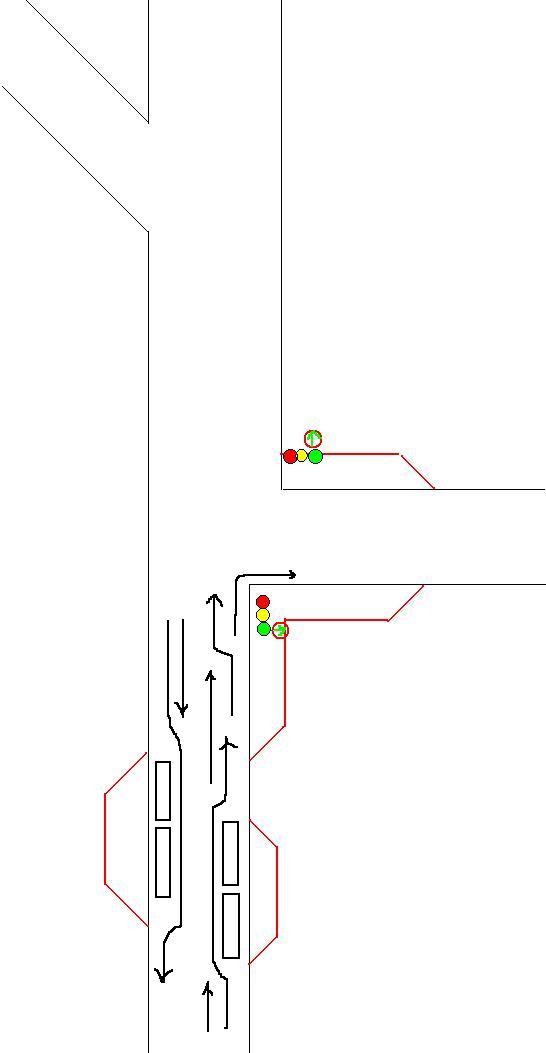

–Ю–±—Й–µ–µ –Њ–њ–Є—Б–∞–љ–Є–µ:

–Я—А–Њ–±–Ї–Є –≤ –Њ–±–Њ–Є—Е –љ–∞–њ—А–∞–≤–ї–µ–љ–Є—П—Е

–Я—А–µ–і–ї–∞–≥–∞–µ–Љ—Л–µ —А–µ—И–µ–љ–Є—П:

–Ю—А–≥–∞–љ–Є–Ј–∞—Ж–Є—П –Њ—Б—В–∞–љ–Њ–≤–Њ—З–љ—Л—Е –Ї–∞—А–Љ–∞–љ–Њ–≤ –і–ї—П –Є—Б–Ї–ї—О—З–µ–љ–Є—П –љ–µ–Њ–±—Е–Њ–і–Є–Љ–Њ—Б—В–Є –Њ–±—К–µ–Ј–і–∞ –Њ–±—Й–µ—Б—В–≤–µ–љ–љ–Њ–≥–Њ —В—А–∞–љ—Б–њ–Њ—А—В–∞.

–†–∞—Б—И–Є—А–µ–љ–Є–µ –Љ–Њ—Б–Ї–Њ–≤—Б–Ї–Њ–є –њ–Њ –љ–∞–њ—А–∞–≤–ї–µ–љ–Є—О –Ї –Ѓ–Ч –Є –Њ—А–≥–∞–љ–Є–Ј–∞—Ж–Є—П –њ–Њ–≤–Њ—А–Њ—В–∞ –љ–∞–њ—А–∞–≤–Њ –љ–∞ —Г–ї. –Х—А–і—П–Ї–Њ–≤–∞ –њ–Њ —Б–≤–µ—В–Њ—Д–Њ—А—Г —Б –і–Њ–њ. —Б–µ–Ї—Ж–Є–µ–є. (–≤–Њ–Ј–Љ–Њ–ґ–љ–∞ —Г—Б—В–∞–љ–Њ–≤–Ї–∞ —Б—В—А–µ–ї–Ї–Є –±–µ–Ј —А–∞—Б—И–Є—А–µ–љ–Є—П: –≥–Њ—А–Є—В –њ—А–Є –Ј–µ–ї–µ–љ–Њ–Љ —Б–≤–µ—В–µ –њ–Њ –Х—А–і—П–Ї–Њ–≤–∞)

–Ъ–Њ–Љ–Љ–µ–љ—В–∞—А–Є–Є

–Ю–±–Ј–Њ—А—Л

Ayr?ca, eger h?zl? yap?st?r?c? nas?l c?kar konusuyla ilgileniyorsan?z, suraya bak?n. Kendiniz gorun: https://evhobisi.com/articles/hizli-yapistirici-elden-asetonsuz-nasil-cikar/

–Ю–±–Ј–Њ—А—Л

"kahve lekesi nas?l c?kar hal?dan" konusu icin burada harika bilgiler var. Iste link: https://kendimacera.com/articles/halidakurumus-kahve-lekesi-nasil-cikar/

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

—И–Ї–Њ–ї–∞-–њ–∞–љ—Б–Є–Њ–љ –±–µ—Б–њ–ї–∞—В–љ–Њ shkola-onlajn-34.ru .

–Ю–±–Ј–Њ—А—Л

lila renk hakk?ndaki bolumu gercekten begendim. Link burada: https://kendifikirler.com/articles/lila-renk-kombinasyonlari/

hop over to this website

learn this here now peripheral cheats

. i97l

El –У–Оmbito del casino en l–У¬≠nea, https://maxxywines.com/2026/01/29/como-cambiar-idioma-y-configuraciones-guia/ presenta amplia experiencia. Participantes pueden disfrutar de entretenciones que van desde ruletas. La diversi–У—Цn de invertir se multiplica en un marco virtual, donde la innovaci–У—Цn desempe–У¬±a un papel crucial. –Т—ЧEst–У–Оs listo para disfrutar del casino en l–У¬≠nea?

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Є–љ—В–µ—А–љ–µ—В-—И–Ї–Њ–ї–∞ shkola-onlajn-31.ru .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ –Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ .

–Ю–±–Ј–Њ—А—Л

Bu arada, eger akrilik boyaya su kat?l?r m? konusuyla ilgileniyorsan?z, buray? inceleyin. Link burada: https://kendifikirler.com/articles/su-bazli-akrilik-boya-kullanimi/

–Ю–±–Ј–Њ—А—Л

Ayr?ca, eger tere hangi ayda ekilir konusuyla ilgileniyorsan?z, buray? inceleyin. Suradan okuyabilirsiniz: https://hobiyapma.com/articles/tere-ekimi-nasil-yapilir/

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Є–љ—В–µ—А–љ–µ—В-—И–Ї–Њ–ї–∞ shkola-onlajn-31.ru .

How It Works OVJT

For extra

buying augmentin without insurance

to verify the claims.

—Г–Ј–љ–∞—В—М –±–Њ–ї—М—И–µ –Ю–њ—В–Є–Љ–Є–Ј–∞—Ж–Є—П –љ–∞–ї–Њ–≥–Њ–≤

–і—А—Г–≥–Є–µ –Ъ—Г–њ–Є—В—М –Э–Ф–°

–Ю–±–Ј–Њ—А—Л

"laminat parke boyas? varm?" konusu icin mukemmel bir kaynak var. Iste link: https://evhobisi.com/articles/laminat-parke-boyasi-mumkun-mu/

see here Zd gl

click now https://Zd.gl/

–Ю–±–Ј–Њ—А—Л

Ayr?ca, eger termal battaniye hangi taraf? konusuyla ilgileniyorsan?z, buray? inceleyin. Kendiniz gorun: https://kendiyolu.com/articles/termal-battaniye-kullanimi-hangi-tarafi-secme/

Drake just went on a hentai barrage on instagram kotaku

Us senator ben cardin angry over senate sex tape linked to

https://schoolgirlxxxpic.tiktok-pornhub.com/?dayana-meaghan

long porn videos of rachel starr the fanny porn asian teen porn jizz drunk anime porn free porn with out flag media

–Ю–±–Ј–Њ—А—Л

Bu arada soyleyeyim, eger silikon nas?l sokulur konusuyla ilgileniyorsan?z, suraya bak?n. Kendiniz gorun: https://kendihobim.com/articles/silikon-sokmenin-pratik-yontemleri/

Lifehack-uri practice ?i sfaturi inteligente pentru a u?ura via?

O idee simpla pentru a-?i imbunata?i ziua вАФ https://www.makeupbrno.cz/2026/03/05/patina-alba-de-pe-coacaze-nu-va-va-...

.

dig this Zd gl

use this link https://Zd.gl

–Ю–±–Ј–Њ—А—Л

Bu arada soyleyeyim, eger balkon demiri kapatma fikirleri konusuyla ilgileniyorsan?z, suraya bak?n. Suradan okuyabilirsiniz: https://kendiyolu.com/articles/bambu-balkon-demiri-kapatma/

canadian pharmacy viagra 50 mg

Certified Canada Rx: https://certifiedcanadarx.shop/# ">canada drugs online reviews - Certified Canada Rx

see this here

like this top dma hardware sellers

visit

recommended you read dma general discussion

1win_zuer

1–≤–Є–љ android http://1win32786.help

My Cat Just Cultured to Open the Cupboard Door

Woke up to descry all the take up bags shredded on the pantry floor. The teensy-weensy wit figured finished the infant lock. How do I gull a cat? https://novabb.ru/ I trouble fortress-level protection

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Ї–ї–∞—Б—Б —Б —Г—З–µ–љ–Є–Ї–∞–Љ–Є shkola-onlajn-32.ru .

uninhibited relatiojship indfore tepat

The work eminence is outstanding. Every medication, annexe, and cosmetic I've ordered has been genuine, fresh, and charmingly packaged. I never get grey hair up receiving expired or pretend products because I guardianship this pharmacopoeia completely.

https://adaguen.com/2026/02/04/pokroile-techniky-v-oblasti-farmacie-jak-...

The person care is exceptional. The staff is suck up to, agreeable, and genuinely helpful. They reach above and beyond to safeguard buyer satisfaction. When I needed better choosing a end-piece for a spelled out health relevant to, they provided such detailed, signed information that I felt like I'd had a consultation with a off the record form expert.

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ-—И–Ї–Њ–ї–∞ –і–ї—П –і–µ—В–µ–є –Њ–љ–ї–∞–є–љ-—И–Ї–Њ–ї–∞ –і–ї—П –і–µ—В–µ–є .

Read More Here

this page

[url=https://forum.direct.top/]dma firmware[/url]

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

—И–Ї–Њ–ї—М–љ–Њ–µ –Њ–±—А–∞–Ј–Њ–≤–∞–љ–Є–µ –Њ–љ–ї–∞–є–љ [url=https://shkola-onlajn-32.ru/]shkola-onlajn-32.ru[/url] .

navigate to these guys

Our site

battlefield dma undetected

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –і–ї—П —И–Ї–Њ–ї—М–љ–Є–Ї–Њ–≤ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –і–ї—П —И–Ї–Њ–ї—М–љ–Є–Ї–Њ–≤ .

–Ю–±–Ј–Њ—А—Л

kilo kayb? neden olur hakk?ndaki makaleyi gercekten begendim. Kendiniz gorun: [url=https://atletikgiyim.com/articles/ani-kilo-kaybi-nedenleri-ve-yonetimi/]https://atletikgiyim.com/articles/ani-kilo-kaybi-nedenleri-ve-yonetimi/[/url]

hop over to this website

this page

bo7 dma cheat

this contact form

why not look here

direct spoofing

computer

How to propose to a girl proposal ideas in Barcelona

click for more info Zd gl

check my blog https://Zd.gl/

look at this web-site Zd gl

news https://Zd.gl/

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –і–ї—П —И–Ї–Њ–ї—М–љ–Є–Ї–Њ–≤ —Б –∞—В—В–µ—Б—В–∞—В–Њ–Љ –Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –і–ї—П —И–Ї–Њ–ї—М–љ–Є–Ї–Њ–≤ —Б –∞—В—В–µ—Б—В–∞—В–Њ–Љ .

1win_wsMn

1win –Ґ–Њ“Ј–Є–Ї–Є—Б—В–Њ–љ android http://1win83254.help/

potato

–Ј–∞–Ї–∞–Ј–∞—В—М –љ–∞–≤–µ—Б —Ж–µ–љ–∞ –Ј–∞–Ї–∞–Ј–∞—В—М –љ–∞–≤–µ—Б –љ–∞ –і–∞—З—Г

have a peek here Zd gl

Extra resources https://Zd.gl

. l347t

Online casinos deliver an exciting approach to engage with gambling from the convenience of your home. With Casino Online, https://hookedonshopping.com/savanna-wins-experience-thrilling-adventures-in/, participants can explore a wide range of games anytime.

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ –Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ –Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ .

Get More Information

check out this site

rainbow six hardware hacks

check my blog

page eac bypass 2025

have a peek at these guys

explanation

anticheat safe dma

–°–Њ–≤–µ—В—Г—О

–≤–∞—А–Є–Ї–Њ—Ж–µ–ї–µ –≤–Є–і—Л –Њ–њ–µ—А–∞—Ж–Є–є

click here now Zd gl

this link https://Zd.gl/