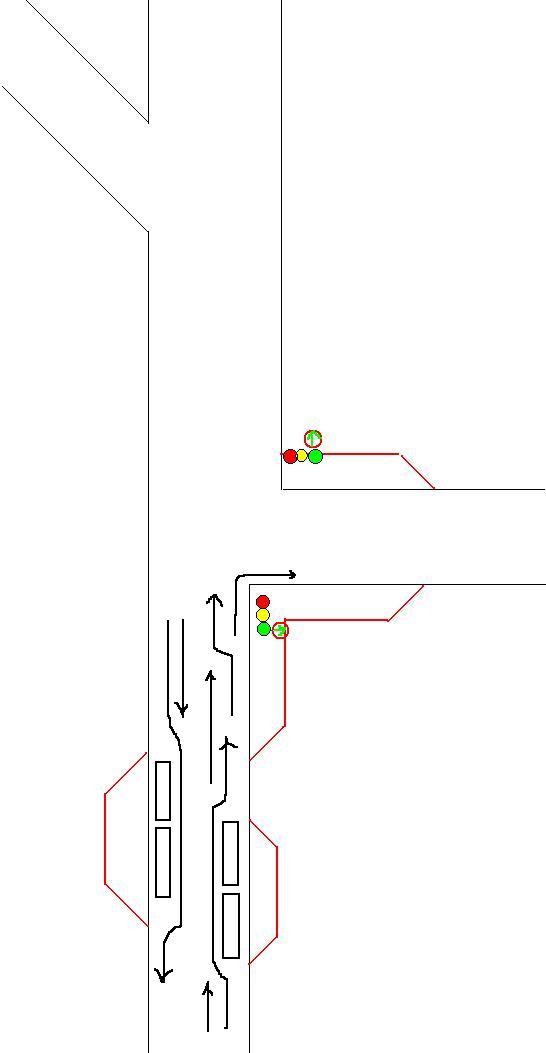

–Ю–±—Й–µ–µ –Њ–њ–Є—Б–∞–љ–Є–µ:

–Я—А–Њ–±–Ї–Є –≤ –Њ–±–Њ–Є—Е –љ–∞–њ—А–∞–≤–ї–µ–љ–Є—П—Е

–Я—А–µ–і–ї–∞–≥–∞–µ–Љ—Л–µ —А–µ—И–µ–љ–Є—П:

–Ю—А–≥–∞–љ–Є–Ј–∞—Ж–Є—П –Њ—Б—В–∞–љ–Њ–≤–Њ—З–љ—Л—Е –Ї–∞—А–Љ–∞–љ–Њ–≤ –і–ї—П –Є—Б–Ї–ї—О—З–µ–љ–Є—П –љ–µ–Њ–±—Е–Њ–і–Є–Љ–Њ—Б—В–Є –Њ–±—К–µ–Ј–і–∞ –Њ–±—Й–µ—Б—В–≤–µ–љ–љ–Њ–≥–Њ —В—А–∞–љ—Б–њ–Њ—А—В–∞.

–†–∞—Б—И–Є—А–µ–љ–Є–µ –Љ–Њ—Б–Ї–Њ–≤—Б–Ї–Њ–є –њ–Њ –љ–∞–њ—А–∞–≤–ї–µ–љ–Є—О –Ї –Ѓ–Ч –Є –Њ—А–≥–∞–љ–Є–Ј–∞—Ж–Є—П –њ–Њ–≤–Њ—А–Њ—В–∞ –љ–∞–њ—А–∞–≤–Њ –љ–∞ —Г–ї. –Х—А–і—П–Ї–Њ–≤–∞ –њ–Њ —Б–≤–µ—В–Њ—Д–Њ—А—Г —Б –і–Њ–њ. —Б–µ–Ї—Ж–Є–µ–є. (–≤–Њ–Ј–Љ–Њ–ґ–љ–∞ —Г—Б—В–∞–љ–Њ–≤–Ї–∞ —Б—В—А–µ–ї–Ї–Є –±–µ–Ј —А–∞—Б—И–Є—А–µ–љ–Є—П: –≥–Њ—А–Є—В –њ—А–Є –Ј–µ–ї–µ–љ–Њ–Љ —Б–≤–µ—В–µ –њ–Њ –Х—А–і—П–Ї–Њ–≤–∞)

–Ъ–Њ–Љ–Љ–µ–љ—В–∞—А–Є–Є

more info here jaxxwallet-web org

home [url=https://jaxxwallet-web.org/]jax wallet[/url]

The best porn sites for women 16 female friendly porn sites la w

Leading porn sites caught by new eu law to police online content

https://bridgeport-yuka-minase.titsamateur.com/?ainsley-patience

gay old young porn aylar free porn video hypnosis teen porn tubes cum on ass porn utbes gay porn lessons dorm education

–Э–µ–є—А–Њ—Б–µ—В–Є –і–ї—П —Г—З–µ–±—Л

–Ґ–∞–Ї–ґ–µ —А–µ–Ї–Њ–Љ–µ–љ–і—Г—О –≤–∞–Љ –њ–Њ—З–Є—В–∞—В—М –њ–Њ —В–µ–Љ–µ - http://fabnews.ru/forum/showthread.php?p=112026#post112026 .

–Ш –µ—Й–µ –≤–Њ—В - https://forum.dneprcity.net/showthread.php?p=1158478#post1158478 .

tripskan

A British man, along with five others, has been charged with carrying out 56 sexual offences against his now ex-wife over a 13-year period.

–°вАЪ–°–В–†—С–†—Ч –°–Г–†—Ф–†¬∞–†–Е

Philip Young has been remanded in custody in relation to the string of charges, which include multiple counts of rape and administering a substance with the intent to overpower to allow sexual activity, according to Wiltshire Police.

tripskan

Young, 49, has also been charged with voyeurism, possession of indecent images of children and possession of extreme images.

tripskan

Five other men, currently on bail, have also been charged with offences against 48-year-old Joanne Young, who waived her legal right to anonymity.

The alleged offences took place between 2010 and 2023.

The men were named by police as Norman Macksoni, 47, who has been charged with one count of rape and possession of extreme images; Dean Hamilton, also 47, who is facing one count of rape and sexual assault by penetration and two counts of sexual touching; 31-year-old Conner Sanderson Doyle, who has been charged with sexual assault by penetration and sexual touching; Richard Wilkins, 61, who faces one count of rape and sexual touching and Mohammed Hassan, 37, who has been charged with sexual touching.

All six men are due to appear at Swindon MagistratesвАЩ Court in southwest England on Tuesday.

Geoff Smith, detective superintendent for Wiltshire police, described the charges as a вАЬsignificant updateвАЭ in a вАЬcomplex and extensive investigation.вАЭ

He added that Joanne Young was being supported by specially trained officers and made the decision to waive her automatic legal right to anonymity вАЬfollowing multiple discussions with officers and support services.вАЭ

James Foster, a Crown Prosecution Service specialist prosecutor, added that the CPS had authorized the charges against the six men вАЬfollowing a police investigation into alleged serious sexual offences against Joanne Young over a period of 13 years.вАЭ

вАЬOur prosecutors have worked to establish that there is sufficient evidence to charge and that it is in the public interest to pursue criminal proceedings,вАЭ he said in a statement.

вАЬWe have worked closely with Wiltshire Police as they carried out their investigation.вАЭ

–°вАЪ–°–В–†—С–†—Ч–°–Г–†—Ф–†¬∞–†–Е –°–Г–†¬∞–†вДЦ–°вАЪ

https://trips63.cc

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

lbs lbs .

online pharmacy without prescription 373 mg

mexica online pharmacy

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

lbs —Н—В–Њ lbs —Н—В–Њ .

his explanation jaxx-web org

my blog jaxx crypto

Video sick gang film brutal sexual assault and beating of woman

Who was nikki grahame and how did big brother star die the

https://spermontits.bestsexyblog.com/?anjali-sydney

free downloadable porn dvd anna nicloe smith porn free free fake celeb porn vids so young fuck porn galleries free aqmateur porn

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –і–ї—П –і–µ—В–µ–є shkola-onlajn12.ru .

big baazi casino

Try your luck and win big with big baazi.

Such simplicity in design elevates the user experience, welcoming both newcomers and experienced gamblers.

–Љ–µ–ї–±–µ—В —А—Г

—Б–∞–є—В –Љ–µ–ї–±–µ—В —Б–∞–є—В –Љ–µ–ї–±–µ—В .

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

—Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–Њ–±–Њ—А—Г–і–Њ–≤–∞–љ–Є—П –Ї–≤–∞—А—В–Є—А—Л pereplanirovka-kvartir3.ru .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Ј–∞–Ї—А—Л—В—Л–µ —И–Ї–Њ–ї—Л –≤ —А–Њ—Б—Б–Є–Є shkola-onlajn12.ru .

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

—Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Њ–Ї —Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Њ–Ї .

—Г–Ј–љ–∞—В—М krab3a cc

–Љ–Њ–ґ–љ–Њ –њ—А–Њ–≤–µ—А–Є—В—М –Ч–Ф–Х–°–ђ https://krab3a.cc

original site jaxxwallet-web org

these details jaxx liberty

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

—И–Ї–Њ–ї–∞-–њ–∞–љ—Б–Є–Њ–љ –±–µ—Б–њ–ї–∞—В–љ–Њ shkola-onlajn14.ru .

–њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л

–Ј–∞–Ї–∞–Ј–∞—В—М –њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л –≤ –Љ–Њ—Б–Ї–≤–µ –Ј–∞–Ї–∞–Ј–∞—В—М –њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л –≤ –Љ–Њ—Б–Ї–≤–µ .

more info here jaxx-web org

try here jaxx

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ —Г—Б–ї—Г–≥–Є pereplanirovka-kvartir4.ru .

–Њ–њ—Г–±–ї–Є–Ї–Њ–≤–∞–љ–Њ –Ј–і–µ—Б—М

–њ–Њ–і—А–Њ–±–љ–µ–µ https://bonus-betting.ru/garilla-casino-promokod/

find this jaxx-web org

have a peek at these guys jaxx wallet

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –і–ї—П –і–µ—В–µ–є —И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –і–ї—П –і–µ—В–µ–є .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Љ–Њ—Б–Ї–Њ–≤—Б–Ї–∞—П —И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –Љ–Њ—Б–Ї–Њ–≤—Б–Ї–∞—П —И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ .

–Ш—Б—В–Њ—З–љ–Є–Ї krdb3

—Н—В–Њ—В —Б–∞–є—В –Љ–∞—А–Ї–µ—В–њ–ї–µ–є—Б

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ –Ї–ї–∞—Б—Б shkola-onlajn11.ru .

Porn stars reveal what really happens during filming and it s

Savannah solo the biggest d ck i ve ever seen youtube

https://minneapolis-adjacent.instasexyblog.com/?tayler-alaina

celebrity online free clip porn how do i block porn sites free young adult hitchhiker porb free porn with old men animal sex porn board

–£–Ј–љ–∞—В—М –±–Њ–ї—М—И–µ

–њ–µ—А–µ–љ–∞–њ—А–∞–≤–ї—П–µ—В—Б—П —Б—О–і–∞ https://kinogo.blue/filmy-2025/1699-moya-geroyskaya-akademiya-vne-zakona...

my response jaxxwallet-web org

recommended you read jax wallet

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –і–Є—Б—В–∞–љ—Ж–Є–Њ–љ–љ–Њ–µ –Њ–±—Г—З–µ–љ–Є–µ shkola-onlajn11.ru .

–љ–∞–ґ–Љ–Є—В–µ –Ј–і–µ—Б—М krdb3

–њ–µ—А–µ–є–і–Є—В–µ –љ–∞ —Н—В–Њ—В —Б–∞–є—В –Ї—А–∞–Ї–µ–љ

read review jaxx-web org

have a peek here jaxx liberty

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤—Б–Ї–∞—П —И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ shkola-onlajn12.ru .

click here now jaxxwallet-web org

browse around here jax wallet

–Ј–і–µ—Б—М krab3a cc

–І–Є—В–∞—В—М –і–∞–ї–µ–µ https://krab3a.cc

navigate to this website jaxx-web org

read the article jaxx wallet

–Р–Ї—В—Г–∞–ї—М–љ—Л–є –Я—А–Њ–Љ–Њ–Ї–Њ–і 1xBet 2026 вАФ –Я–Њ–ї—Г—З–Є—В–µ –і–Њ 32 500 —А—Г–±

1—Е –±–µ—В –њ—А–Њ–Љ–Њ–Ї–Њ–і –Т–≤–Њ–і–Є—В–µ –њ—А–Њ–Љ–Њ–Ї–Њ–і –љ–∞ http://www.archproject3.ru/img/pages/promokod_144.html –Є –∞–Ї—В–Є–≤–Є—А—Г–є—В–µ 100% –Ї –њ–µ—А–≤–Њ–Љ—Г –і–µ–њ–Њ–Ј–Є—В—Г –і–ї—П –Ї–Њ–Љ—Д–Њ—А—В–љ–Њ–≥–Њ —Б—В–∞—А—В–∞ –Є–≥—А—Л.

day-dream high-principled plenitude misshape

What worked for me was starting small and scaling gradually. I'd buy twitter followers in batches of 100-200 every few weeks, which kept the growth looking natural while steadily building credibility. Too fast looks suspicious, too slow wastes the opportunity.

—Б—О–і–∞ krdb3

–љ–∞–ґ–Љ–Є—В–µ –Ј–і–µ—Б—М –Ї—А–∞

–≤–µ–±-—Б–∞–є—В krdb3

–њ–µ—А–µ–є–і–Є—В–µ –љ–∞ —Н—В–Њ—В —Б–∞–є—В –Љ–∞–≥–∞–Ј–Є–љ

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ –Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ .

check these guys out jaxx-web org

this jaxx

–°–Љ–Њ—В—А–µ—В—М –Ј–і–µ—Б—М krab3a cc

–њ—А–Њ–≤–µ—А–Є—В—М —Б–∞–є—В https://krab3a.cc

–≤ —Н—В–Њ–Љ —А–∞–Ј–і–µ–ї–µ krab3a cc

–Я–Њ–і—А–Њ–±–љ–µ–µ –Ј–і–µ—Б—М https://krab3a.cc

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–і–Є—Б—В–∞–љ—Ж–Є–Њ–љ–љ–Њ–µ —И–Ї–Њ–ї—М–љ–Њ–µ –Њ–±—Г—З–µ–љ–Є–µ –і–Є—Б—В–∞–љ—Ж–Є–Њ–љ–љ–Њ–µ —И–Ї–Њ–ї—М–љ–Њ–µ –Њ–±—Г—З–µ–љ–Є–µ .

seattletowncar - ??????

Manta company profile page for Seattle Town Car showing key business facts like address and phone in Seattle. ItвАЩs a straightforward directory entry for reference and lookup. Open: Seattle Town Car on Manta.

–Я—А–Њ–Љ–Њ–Ї–Њ–і 1xBet 2026 вАФ –Я–Њ–ї—Г—З–Є—В–µ 100% –љ–∞ –Ф–µ–њ–Њ–Ј–Є—В –і–Њ 32 500 —А—Г–±

–і–µ–є—Б—В–≤—Г—О—Й–Є–µ –њ—А–Њ–Љ–Њ–Ї–Њ–і—Л 1xbet –Т–≤–Њ–і–Є—В–µ –њ—А–Њ–Љ–Њ–Ї–Њ–і –љ–∞ https://trustentec.ru/media/pgs/1xbet_promokod_bonus__4.html –Є –њ–Њ–ї—Г—З–Є—В–µ 100% –Ї –њ–µ—А–≤–Њ–Љ—Г –і–µ–њ–Њ–Ј–Є—В—Г –і–ї—П –Ї–Њ–Љ—Д–Њ—А—В–љ–Њ–≥–Њ —Б—В–∞—А—В–∞ –Є–≥—А—Л.

10 best private torrent sites in 2023 to download torrents

Sexy black lingerie porn pics naked photos pornpics

https://catownerjokes.fetlifeblog.com/?felicity-mercedes

rape porn thumbnails free long porn vidieos classic porn dump hot sexy pamela anderson porn porn actress adora

2023 s top ten hottest incest onlyfans accounts the village

11 sites like omegle best adult chatroulette websites and adult

https://mature-sophye.xblognetwork.com/?juliet-kiersten

portrayal of porn auditions free ebony porn mobile clips xxx porn girl spreds legs free hidden camera porn movies amatue teen home porn movies