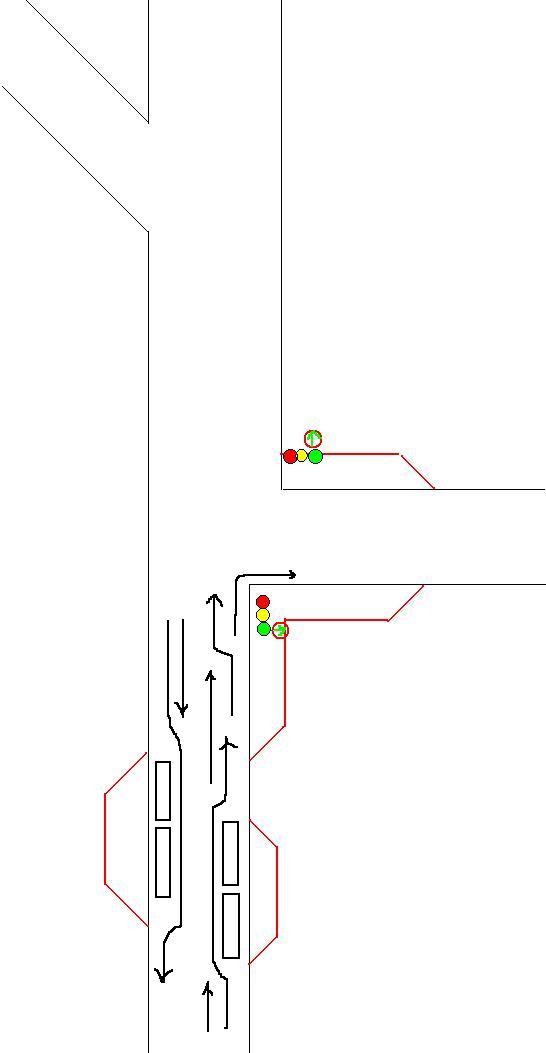

–Ю–±—Й–µ–µ –Њ–њ–Є—Б–∞–љ–Є–µ:

–Я—А–Њ–±–Ї–Є –≤ –Њ–±–Њ–Є—Е –љ–∞–њ—А–∞–≤–ї–µ–љ–Є—П—Е

–Я—А–µ–і–ї–∞–≥–∞–µ–Љ—Л–µ —А–µ—И–µ–љ–Є—П:

–Ю—А–≥–∞–љ–Є–Ј–∞—Ж–Є—П –Њ—Б—В–∞–љ–Њ–≤–Њ—З–љ—Л—Е –Ї–∞—А–Љ–∞–љ–Њ–≤ –і–ї—П –Є—Б–Ї–ї—О—З–µ–љ–Є—П –љ–µ–Њ–±—Е–Њ–і–Є–Љ–Њ—Б—В–Є –Њ–±—К–µ–Ј–і–∞ –Њ–±—Й–µ—Б—В–≤–µ–љ–љ–Њ–≥–Њ —В—А–∞–љ—Б–њ–Њ—А—В–∞.

–†–∞—Б—И–Є—А–µ–љ–Є–µ –Љ–Њ—Б–Ї–Њ–≤—Б–Ї–Њ–є –њ–Њ –љ–∞–њ—А–∞–≤–ї–µ–љ–Є—О –Ї –Ѓ–Ч –Є –Њ—А–≥–∞–љ–Є–Ј–∞—Ж–Є—П –њ–Њ–≤–Њ—А–Њ—В–∞ –љ–∞–њ—А–∞–≤–Њ –љ–∞ —Г–ї. –Х—А–і—П–Ї–Њ–≤–∞ –њ–Њ —Б–≤–µ—В–Њ—Д–Њ—А—Г —Б –і–Њ–њ. —Б–µ–Ї—Ж–Є–µ–є. (–≤–Њ–Ј–Љ–Њ–ґ–љ–∞ —Г—Б—В–∞–љ–Њ–≤–Ї–∞ —Б—В—А–µ–ї–Ї–Є –±–µ–Ј —А–∞—Б—И–Є—А–µ–љ–Є—П: –≥–Њ—А–Є—В –њ—А–Є –Ј–µ–ї–µ–љ–Њ–Љ —Б–≤–µ—В–µ –њ–Њ –Х—А–і—П–Ї–Њ–≤–∞)

–Ъ–Њ–Љ–Љ–µ–љ—В–∞—А–Є–Є

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –і–ї—П —И–Ї–Њ–ї—М–љ–Є–Ї–Њ–≤ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ –і–ї—П —И–Ї–Њ–ї—М–љ–Є–Ї–Њ–≤ .

Xkh 3 Ujmp Zts

1xbet free bet promo code today

–Ъ–ї–Є–љ–Є–Ї–∞ —Н—Б—В–µ—В–Є—З–µ—Б–Ї–Њ–є –Љ–µ–і–Є—Ж–Є–љ—Л –Є –Ї–Њ—Б–Љ–µ—В–Њ–ї–Њ–≥–Є–Є –≤ –Х–Ї–∞—В–µ—А–Є–љ–±—Г—А–≥–µ

–£–љ–Є–Ї–∞–ї—М–љ—Л–µ —Г—Б–ї—Г–≥–Є –љ–∞—И–µ–є –Ї–ї–Є–љ–Є–Ї–Є —Н—Б—В–µ—В–Є—З–µ—Б–Ї–Њ–є –Љ–µ–і–Є—Ж–Є–љ—Л ST-Clinic, —А–∞–Ј—А–∞–±–Њ—В–∞–љ–љ—Л–µ —Б–њ–µ—Ж–Є–∞–ї—М–љ–Њ –і–ї—П —Б–Њ—Е—А–∞–љ–µ–љ–Є—П –Љ–Њ–ї–Њ–і–Њ—Б—В–Є –Є —Б–≤–µ–ґ–µ—Б—В–Є –≤–∞—И–µ–≥–Њ –ї–Є—Ж–∞. –Ь—Л –њ—А–µ–і–ї–∞–≥–∞–µ–Љ –Є–љ–љ–Њ–≤–∞—Ж–Є–Њ–љ–љ—Л–µ —А–µ—И–µ–љ–Є—П, —Б–њ–Њ—Б–Њ–±–љ—Л–µ –њ–Њ–і–∞—А–Є—В—М –≤–∞–Љ –Њ—Й—Г—Й–µ–љ–Є–µ —Г–≤–µ—А–µ–љ–љ–Њ—Б—В–Є –Є –њ—А–Є–≤–ї–µ–Ї–∞—В–µ–ї—М–љ–Њ—Б—В–Є –≤–љ–µ –Ј–∞–≤–Є—Б–Є–Љ–Њ—Б—В–Є –Њ—В –≤–Њ–Ј—А–∞—Б—В–∞:

–Ы–Є–Љ—Д–Њ–і—А–µ–љ–∞–ґ–љ—Л–є –Љ–∞—Б—Б–∞–ґ –ї–Є—Ж–∞ –і–ї—П –љ–∞ —Г—Б—В—А–∞–љ–µ–љ–Є—П –Ј–∞—Б—В–Њ–µ–≤ –ґ–Є–і–Ї–Њ—Б—В–Є –Є –≤–Њ—Б—Б—В–∞–љ–Њ–≤–ї–µ–љ–Є—П —Ж–≤–µ—В–∞ –Ї–Њ–ґ–Є. –°–Њ–≤—А–µ–Љ–µ–љ–љ—Л–µ –Љ–µ—В–Њ–і–Є–Ї–Є –њ–Њ–і—В—П–ґ–Ї–Є –Ї–Њ–ґ–Є –ї–Є—Ж–∞ –і–ї—П —Г—Б—В—А–∞–љ–µ–љ–Є—П –Љ–Њ—А—Й–Є–љ –Є –њ–Њ–≤—Л—И–µ–љ–Є—П —Г–њ—А—Г–≥–Њ—Б—В–Є –Ї–Њ–ґ–Є. –Ъ–Њ–љ—В—Г—А–љ–∞—П –њ–ї–∞—Б—В–Є–Ї–∞ –ї–Є—Ж–∞ –і–ї—П –Ї–Њ—А—А–µ–Ї—Ж–Є–Є –Ї–Њ–љ—В—Г—А–Њ–≤ –ї–Є—Ж–∞ –Є –њ–Њ–і—З–µ—А–Ї–Є–≤–∞–љ–Є—П –Њ—Б–Њ–±–µ–љ–љ–Њ—Б—В–µ–є –≤–љ–µ—И–љ–Њ—Б—В–Є. –Т—Л—А–∞–Ј–Є—В–µ–ї—М–љ—Л–µ –Є —Б–Њ–±–ї–∞–Ј–љ–Є—В–µ–ї—М–љ—Л–µ –≥—Г–±—Л –±–ї–∞–≥–Њ–і–∞—А—П –њ—А–Њ—Ж–µ–і—Г—А–∞–Љ –Ї–Њ–љ—В—Г—А–љ–Њ–є –њ–ї–∞—Б—В–Є–Ї–Є –≥—Г–±.

check my site jaxx-web org

check my source jaxx wallet

–Љ–µ–ї–±–µ—В —А—Г

–Љ–µ–ї–±–µ—В –њ–Њ–ї–љ–∞—П –≤–µ—А—Б–Є—П –Љ–µ–ї–±–µ—В –њ–Њ–ї–љ–∞—П –≤–µ—А—Б–Є—П .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Љ–Њ—Б–Ї–Њ–≤—Б–Ї–∞—П —И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ shkola-onlajn12.ru .

–њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л

–Ј–∞–Ї–∞–Ј–∞—В—М –њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ј–∞–Ї–∞–Ј–∞—В—М –њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є .

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

—Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Њ–Ї —Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Њ–Ї .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ 11 –Ї–ї–∞—Б—Б –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ 11 –Ї–ї–∞—Б—Б .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–і–Є—Б—В–∞–љ—Ж–Є–Њ–љ–љ–Њ–µ —И–Ї–Њ–ї—М–љ–Њ–µ –Њ–±—Г—З–µ–љ–Є–µ shkola-onlajn12.ru .

Watch free asian shoplifting porn videos on tnaflix porn tube

Porn 4 real is a real porn videos catalogue at porn 4 real we

https://freemikfporn-movinghouseimagesfunny.tiktokpornstar.com/?bella-eden

porn video hubby bred lesbian milf free porn ongest list porn naked teen porn pics cousin cousin porn

Why We Wire HVAC Systems Backward: The Climate Control Lesson We

Here's the harsh truth: the majority of HVAC failures occur because someone missed a step. Failed to calculate the load accurately. Used cheap equipment. Misjudged the insulation needs. We've personally fixed hundreds of these failures. And each time, we remember another lesson. Like in 2017, when we started adding remote monitoring to every installation. Why? Because Sarah, our master tech, got frustrated of watching homeowners lose money on bad temperature management. Now clients save $500+ yearly.

https://www.demilked.com/author/ellachuduj/

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ-—И–Ї–Њ–ї–∞ –і–ї—П –і–µ—В–µ–є shkola-onlajn14.ru .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Ї—Г—А—Б—Л —Б—В—А–Є–Љ–Є–љ–≥ shkola-onlajn11.ru .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

lbs —З—В–Њ —Н—В–Њ lbs —З—В–Њ —Н—В–Њ .

reparacion de maquinaria agricola

equilibrado informatico

https://vibromera.es/equilibrado-informatico/

Sistemas de balanceo: fundamentales para el desempeno suave y eficiente de las maquinas

En el entorno de la innovacion tecnologica, donde la productividad y la fiabilidad del equipo son de maxima importancia, los sistemas de equilibrado desempenan un funcion esencial. Estos instrumentos tecnicos estan creados con el fin de equilibrar y estabilizar partes rotativas, ya sea en equipos industriales, automoviles y camiones o incluso en equipos domesticos.

Para los tecnicos de servicio y los ingenieros, trabajar con sistemas de balanceo es fundamental para mantener el trabajo seguro y continuo de cualquier equipo con partes en movimiento. Gracias a estas innovaciones en equilibrado, es posible reducir significativamente las oscilaciones, el sonido no deseado y la carga sobre los cojinetes, aumentando la resistencia de piezas de alto valor.

Igualmente relevante es el papel que ejercen los equipos de balanceo en la relacion con los usuarios. El servicio postventa y el cuidado preventivo utilizando estos sistemas garantizan servicios de alta calidad, mejorando la experiencia del usuario.

Para los empresarios, la implementacion en estaciones de balanceo y sensores puede ser determinante para aumentar la capacidad y resultados de sus equipos. Esto es especialmente importante para los administradores de negocios medianos, donde cada detalle cuenta.

Ademas, los equipos de balanceo tienen una versatilidad en el ambito de la prevencion y aseguramiento. Sirven para identificar defectos, ahorrando gastos elevados y averias graves. Mas aun, los resultados extraidos de estos sistemas se aplican para mejorar la produccion.

Las industrias objetivo de los equipos de balanceo abarcan diversas industrias, desde la fabricacion de bicicletas hasta el monitoreo ambiental. No importa si se trata de fabricas de gran escala o negocios familiares, los equipos de balanceo son imprescindibles para mantener la productividad sin fallos.

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ –ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ shkola-onlajn11.ru .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–ї–Њ–Љ–Њ–љ–Њ—Б–Њ–≤ —И–Ї–Њ–ї–∞ shkola-onlajn12.ru .

8 online best dark web search engines for tor browser 2022

59 kristen bell sexy pictures prove she is hotter than tobasco

https://painfulcartoonporn-hdpusyphoto.a4ktube.com/?kaitlin-angeline

vintage bi porn trample porn longest lists of porn video japanese teacher av porn bright porn teenage

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Љ–Њ—Б–Ї–Њ–≤—Б–Ї–∞—П —И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ –Њ–±—Г—З–µ–љ–Є–µ shkola-onlajn14.ru .

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

–≥–і–µ —Б–Њ–≥–ї–∞—Б–Њ–≤–∞—В—М –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї—Г pereplanirovka-kvartir3.ru .

canada drugs pharmacy online

I do not know whether it's just me or if everybody else experiencing issues with your site. It appears as if some of the written text in your posts are running off the screen. Can somebody else please comment and let me know if this is happening to them too? This might be a issue with my internet browser because I've had this happen previously. Appreciate it

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–і–Є—Б—В–∞–љ—Ж–Є–Њ–љ–љ–Њ–µ —И–Ї–Њ–ї—М–љ–Њ–µ –Њ–±—Г—З–µ–љ–Є–µ shkola-onlajn11.ru .

reputable online pharmacy 136 mg

mexmedimax

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –њ–Њ–Љ–µ—Й–µ–љ–Є—П pereplanirovka-kvartir4.ru .

navarro pharmacy

It's an awesome article designed for all the web visitors; they will obtain advantage from it I am sure.

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

—Г–Ј–∞–Ї–Њ–љ–Є–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є —Г–Ј–∞–Ї–Њ–љ–Є–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є .

–њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л

–Ј–∞–Ї–∞–Ј–∞—В—М –њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л –Ј–∞–Ї–∞–Ј–∞—В—М –њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л .

Katrina moreno porn videos verified pornstar profile pornhub

Suikoden funny cocks best free porn r34 futanari shemale

https://calves-fake-boops-symptoms-pics.titsamateur.com/?kailey-joslyn

peitite girl porn free high quality porn full length alma choa porn star extrem sports porn kidie porn pictures

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

—Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л –Љ–Њ—Б–Ї–≤–∞ pereplanirovka-kvartir5.ru .

–њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л

–њ—А–Њ–µ–Ї—В–љ–∞—П –Њ—А–≥–∞–љ–Є–Ј–∞—Ж–Є—П –і–ї—П –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л proekt-pereplanirovki-kvartiry20.ru .

pipedream charmed aftermath

–Т—Б—С, —З—В–Њ –≤–∞–ґ–љ–Њ https://inclub.lg.ua –ґ–µ–љ—Й–Є–љ–µ: –Ј–і–Њ—А–Њ–≤—М–µ –Є –≥–Њ—А–Љ–Њ–љ—Л, –њ–Є—В–∞–љ–Є–µ –Є —Д–Є—В–љ–µ—Б, —Б—В–Є–ї—М –Є –≥–∞—А–і–µ—А–Њ–±, –Њ—В–љ–Њ—И–µ–љ–Є—П –Є —Б–∞–Љ–Њ–Њ—Ж–µ–љ–Ї–∞, —Г—О—В –Є —А–µ—Ж–µ–њ—В—Л. –≠–Ї—Б–њ–µ—А—В–љ—Л–µ —Б—В–∞—В—М–Є, —В–µ—Б—В—Л –Є –њ–Њ–і–±–Њ—А–Ї–Є. –°–Њ—Е—А–∞–љ—П–є—В–µ –ї—О–±–Є–Љ–Њ–µ –Є –і–µ–ї–Є—В–µ—Б—М вАФ —Г–і–Њ–±–љ–Њ –љ–∞ —В–µ–ї–µ—Д–Њ–љ–µ.

—Б–Ї–Њ–ї—М–Ї–Њ —Б—В–Њ–Є—В —Г–Ј–∞–Ї–Њ–љ–Є—В—М –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї—Г

—Б–Ї–Њ–ї—М–Ї–Њ —Б—В–Њ–Є—В —Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є —Б–Ї–Њ–ї—М–Ї–Њ —Б—В–Њ–Є—В —Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є .

wool-gathering happenstance mistranslate

–Я–Њ—А—В–∞–ї –і–ї—П –ґ–µ–љ—Й–Є–љ https://beautyrecipes.kyiv.ua –њ—А–Њ –≥–∞—А–Љ–Њ–љ–Є—О –Є —А–µ–Ј—Г–ї—М—В–∞—В: –Ј–і–Њ—А–Њ–≤—М–µ, –Ї—А–∞—Б–Њ—В–∞, —Б—В–Є–ї—М, —Б–∞–Љ–Њ—А–∞–Ј–≤–Є—В–Є–µ, —Б–µ–Љ—М—П –Є –Њ—В–љ–Њ—И–µ–љ–Є—П. –Ю–±–Ј–Њ—А—Л –Ї–Њ—Б–Љ–µ—В–Є–Ї–Є –Є –њ—А–Њ—Ж–µ–і—Г—А, –њ–ї–∞–љ—Л –њ–Є—В–∞–љ–Є—П, —В—А–µ–љ–Є—А–Њ–≤–Ї–Є, —Б–Њ–≤–µ—В—Л –њ–Њ –і–Њ–Љ—Г –Є –≤–і–Њ—Е–љ–Њ–≤–ї—П—О—Й–Є–µ –Є—Б—В–Њ—А–Є–Є. –Т—Б—С –≤ –Њ–і–љ–Њ–Љ –Љ–µ—Б—В–µ, 24/7.

Mtt 1 Wblf Yvv

1xbet welcome bonus code

mirage happenstance fuck mess

–Я–Њ—А—В–∞–ї –і–ї—П –ґ–µ–љ—Й–Є–љ https://angela.org.ua –Њ —Б–Њ–≤—А–µ–Љ–µ–љ–љ–Њ–Љ –ї–∞–є—Д—Б—В–∞–є–ї–µ: –±—М—О—В–Є-—А—Г—В–Є–љ—Л, –Љ–Њ–і–∞, –Ј–і–Њ—А–Њ–≤—М–µ, –њ—А–∞–≤–Є–ї—М–љ–Њ–µ –њ–Є—В–∞–љ–Є–µ, –Њ—В–љ–Њ—И–µ–љ–Є—П, —А–∞–±–Њ—В–∞ –Є –Њ—В–і—Л—Е. –Я–Њ–ї–µ–Ј–љ—Л–µ –њ–Њ–і–±–Њ—А–Ї–Є, —З–µ—Б—В–љ—Л–µ –Њ–±–Ј–Њ—А—Л, –Є—Б—В–Њ—А–Є–Є –Є —Б–Њ–≤–µ—В—Л —Н–Ї—Б–њ–µ—А—В–Њ–≤ вАФ –Ј–∞—Е–Њ–і–Є—В–µ –Ј–∞ –≤–і–Њ—Е–љ–Њ–≤–µ–љ–Є–µ–Љ 24/7.

–Љ–µ–ї–±–µ—В —А—Г

–Љ–µ–ї –±–µ—В –Љ–µ–ї –±–µ—В .

Ure archives page 3 of 6 jav guru japanese porn tube

Dirty amateur spy sex videos hidden camera porn tube

https://jolene-jolene.a4ktube.com/?marlee-jaylene

hood rat ass porn porn fimale ninja 3 free pov virtual sex porn free adult porn pictureview passwords old mature grany porn

Teen blowjob clips that will please every fan of blowjob porn vi

Pornhub et trois autres sites pornos ultra consult s

https://mannheim-itoh.a4ktube.com/?mikaela-kaylee

longest long porn free hot sex porn videos sex porn ppt free young porn films comic art porn tits

–њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л

—Б–і–µ–ї–∞—В—М –њ—А–Њ–µ–Ї—В –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–Є –Ї–≤–∞—А—В–Є—А—Л –≤ –Љ–Њ—Б–Ї–≤–µ proekt-pereplanirovki-kvartiry20.ru .

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А—Л –Љ–Њ—Б–Ї–≤–∞ –њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А—Л –Љ–Њ—Б–Ї–≤–∞ .

Xxg 2 Xwdm Iec

https://jobs.lifewest.edu/employer/1xbetcode2026/?v=c419b06b4c65

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А pereplanirovka-kvartir3.ru .

—И–Ї–Њ–ї–∞ –Њ–љ–ї–∞–є–љ

–Њ–љ–ї–∞–є–љ —И–Ї–Њ–ї–∞ —Б 1 –њ–Њ 11 –Ї–ї–∞—Б—Б shkola-onlajn13.ru .

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

—Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–Њ–±–Њ—А—Г–і–Њ–≤–∞–љ–Є—П –Ї–≤–∞—А—В–Є—А—Л pereplanirovka-kvartir3.ru .

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А—Л –≤ –Љ–Њ—Б–Ї–≤–µ pereplanirovka-kvartir4.ru .

Free porn tube best porn videos from tubes beeg porn

Rare animal sex video collection featuring a huge k9 luxuretv

https://white-wallpaper-european.instakink.com/?denisse-anya

porn vedis cartoon bear porn english porn site amsterdam dutch porn moms boobs porn tube

–њ–µ—А–µ–њ–ї–∞–љ–Є—А–Њ–≤–Ї–∞ –Ї–≤–∞—А—В–Є—А

—Б–Њ–≥–ї–∞—Б–Њ–≤–∞–љ–Є–µ –њ–µ—А–µ–Њ–±–Њ—А—Г–і–Њ–≤–∞–љ–Є—П –Ї–≤–∞—А—В–Є—А—Л pereplanirovka-kvartir4.ru .

–Љ–µ–ї–±–µ—В —А—Г

melbet –±—Г–Ї–Љ–µ–Ї–µ—А—Б–Ї–∞—П –Ї–Њ–љ—В–Њ—А–∞ melbet –±—Г–Ї–Љ–µ–Ї–µ—А—Б–Ї–∞—П –Ї–Њ–љ—В–Њ—А–∞ .

Why are there so many deepfakes of bollywood actresses bbc

Teen mom s tyler baltierra joins onlyfans with wife catelynn s

https://ariesbennett.sexyico.com/?makena-kaylynn

trashing women porn hannamotana porn andhra great porn movie clips vintage tranny porn tube 3d porn hard amanda